The Rise of Generative AI in Financial Analysis

Generative AI is poised to transform how we extract insights from financial data. Systems like Claude can read and comprehend financial statements, filings, and reports to provide useful summaries and analysis. This technology can revolutionize how individuals and organizations evaluate companies, industries, and markets. This post is intended to provide an example of the capabilities of generative A.I., using the tool Claude.ai created by Anthropic. I wanted to assess if Claude would be able to perform an analysis of Tesla’s most recent quarterly 10-Q (Q2 2023) based on a blog post written by Calcbench, “Parsing Tesla’s Latest Numbers“

Summary of CalcBench Post

In the post Calcbench describe Tesla’s disclosures as frustrating for analysts seeking operational and financial insights. But Calcbench’s tools can still help with analysis using available data. In the end, Calcbench was able to show the trend of Tesla’s Revenue by market segment from Q1 2020 to Q2 2023. Calcbench utilized Tesla’s XBRL filings for the analysis and observed:

That’s some mighty sharp and steady growth in the U.S. region (blue line) with rest of the world (yellow line) following a similar trajectory except for one dip in mid-2022. China (red line) is poking along at a somewhat lower pace.

The rest of the post switches to the need to manually identify important information in order to ascertain the average per vehicle sold of, $43,804 for Q2 2023.

What knowledge is needed to to analyze publicly traded company financial information?

I asked both Claude and ChatGPT, What areas of expertise would a person need to have to use Calcbench in order to analyze the financial report of a publicly traded company? List them in bullet form. Below are the results:

From Claude:

Here are some areas of expertise a person would need to effectively analyze a company’s financial report using Calcbench:

- Accounting knowledge – An understanding of accounting principles, standards, and methods is critical for analyzing financial reports. This includes knowledge of the income statement, balance sheet, cash flow statement, footnotes, revenue recognition, depreciation, goodwill, etc.

- Financial statement analysis – The ability to read and interpret financial statements is key. This involves analyzing profitability, liquidity, leverage, efficiency, and other metrics based on the reported financial data.

- Industry knowledge – Understanding the dynamics and metrics of the industry the company operates in provides context for analyzing performance. Knowledge of competitive forces, trends, and norms is helpful.

- Understanding of accounting regulations – An awareness of GAAP, IFRS, and SEC reporting requirements helps ensure proper analysis that complies with regulations. Keeps analyst updated on regulation changes.

- Financial modeling skills – The ability to build models using historical data to project future financial performance provides additional insight from reports. Requires knowledge of Excel, valuation, discounted cash flows, etc.

- Research skills – Can utilize various resources to supplement analysis such as economic data, industry reports, competitor analysis, news, and management commentary. Provides fuller picture.

- Critical thinking – Ability to interpret the numbers, spot inconsistencies, raise questions, assess quality of earnings, and draw insights from financial reports. Requires skepticism and attention to detail.

From ChatGPT:

To effectively use Calcbench for financial analysis of a publicly traded company, a person would need expertise in the following areas:

- Financial Statement Analysis: Understanding how to read and interpret financial statements such as balance sheets, income statements, and cash flow statements.

- Accounting Principles: Familiarity with generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) to accurately assess financial data.

- Financial Metrics: Knowledge of key financial metrics and ratios like earnings per share (EPS), price-to-earnings (P/E) ratio, return on equity (ROE), etc.

- Industry Knowledge: Awareness of the specific industry the company operates in, as financial performance can vary significantly between industries.

- Securities Regulation: Understanding of securities laws and regulations that govern the reporting and disclosure requirements of publicly traded companies.

- Data Analysis: Proficiency in data analysis techniques to extract relevant information from the large datasets available on Calcbench.

- Corporate Finance: Knowledge of corporate finance concepts, such as cost of capital, capital structure, and valuation methods.

- Economic Factors: Awareness of macroeconomic factors that can impact a company’s performance, such as interest rates, inflation, and economic growth.

- Market Research: Ability to conduct market research to gain insights into the company’s competitive landscape and market trends.

- Forecasting: Skills in financial forecasting and modeling to project future financial performance based on historical data.

- Software Proficiency: Familiarity with using financial analysis tools and platforms, including Calcbench, to efficiently navigate and analyze financial data.

Keep in mind that while expertise in these areas is valuable, Calcbench is designed to provide a user-friendly interface, making it accessible to a broad range of users with varying levels of financial expertise.

Claude’s Analysis of Tesla

The remainder of this post will examine how Claude analyzed Tesla’s data. A few things to keep in mind. I only used Tesla’s Q2 2023 10Q, so the trend analysis was only done for the two quarters reported Q1 2023 and Q2 2023. Other than that I wanted to see if Claude could produce the same results as Calcbench, albeit with less of a need for the above areas of expertise. All that was needed was for me to use the correct prompt.

My first step was to save the 10-Q as a .pdf file, which I submitted to Claude and prompted with Tesla Q2 Earnings. I did not ask any questions, Claude understood the data to be a 10Q and provided the following analysis (I’ve highlighted the values that match those from Calcbench):

Based on my review of Tesla’s 10-Q filing for Q2 2023, here are some key takeaways:

- Tesla reported total revenues of $24.9 billion in Q2 2023, up 47% from $16.9 billion in Q2 2022. Automotive sales revenue was $20.4 billion, up 49% year-over-year.

- Net income attributable to common shareholders was $2.7 billion in Q2 2023, compared to $2.3 billion in Q2 2022.

- Automotive gross margin declined from 27.9% in Q2 2022 to 19.2% in Q2 2023, primarily due to lower average selling prices and underutilization of new factories.

- Operating expenses were $2.1 billion in Q2 2023, up 41% from $1.8 billion in Q2 2022, driven by higher R&D and SG&A expenses.

- Cash and cash equivalents grew to $15.3 billion at the end of Q2 2023, compared to $16.3 billion at the end of 2022.

- Capital expenditures were $4.1 billion in the first half of 2023, mainly related to expansions at Tesla’s factories. The company expects capex of $7-9 billion in 2023.

- Vehicle deliveries were 889,015 in Q2 2023, up 57% from 564,743 in Q2 2022. Model 3/Y deliveries grew 61% year-over-year.

- Tesla reiterated its goal to grow vehicle deliveries by 50% per year over a multi-year period.

In summary, Tesla delivered strong top-line growth but lower automotive margins in Q2. Cash generation remained robust even with high capex spending. Vehicle demand and production continued to grow rapidly year-over-year.

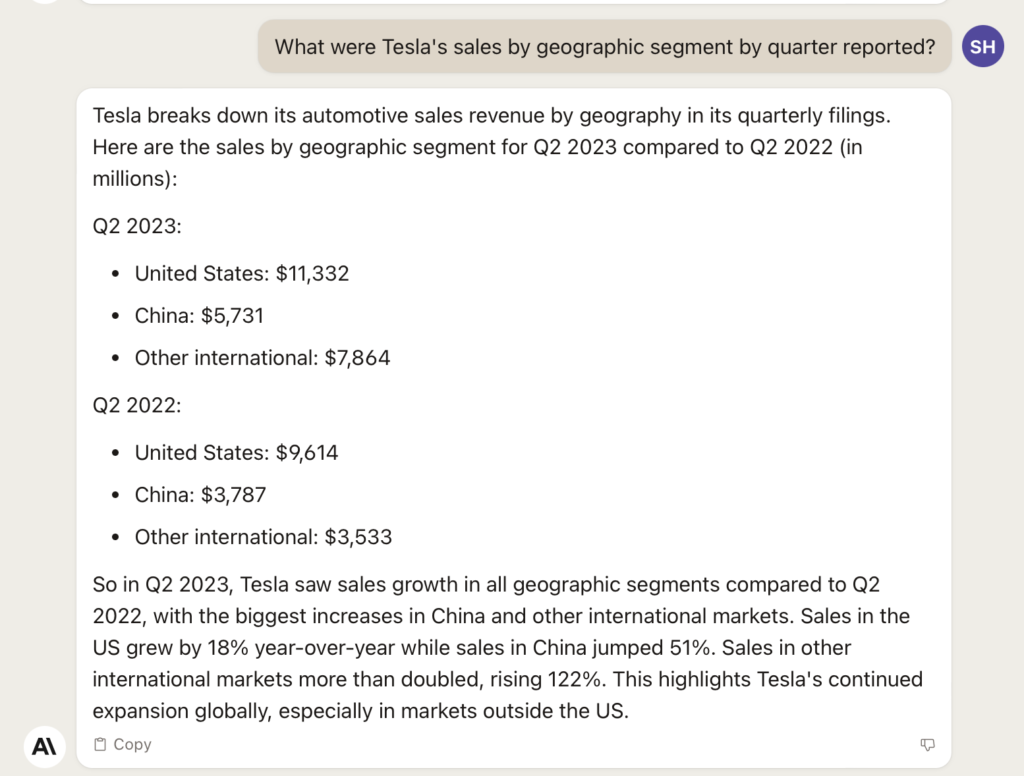

Next I wanted to see if Claude could calculate Sales by geographic region, which it was able to do:

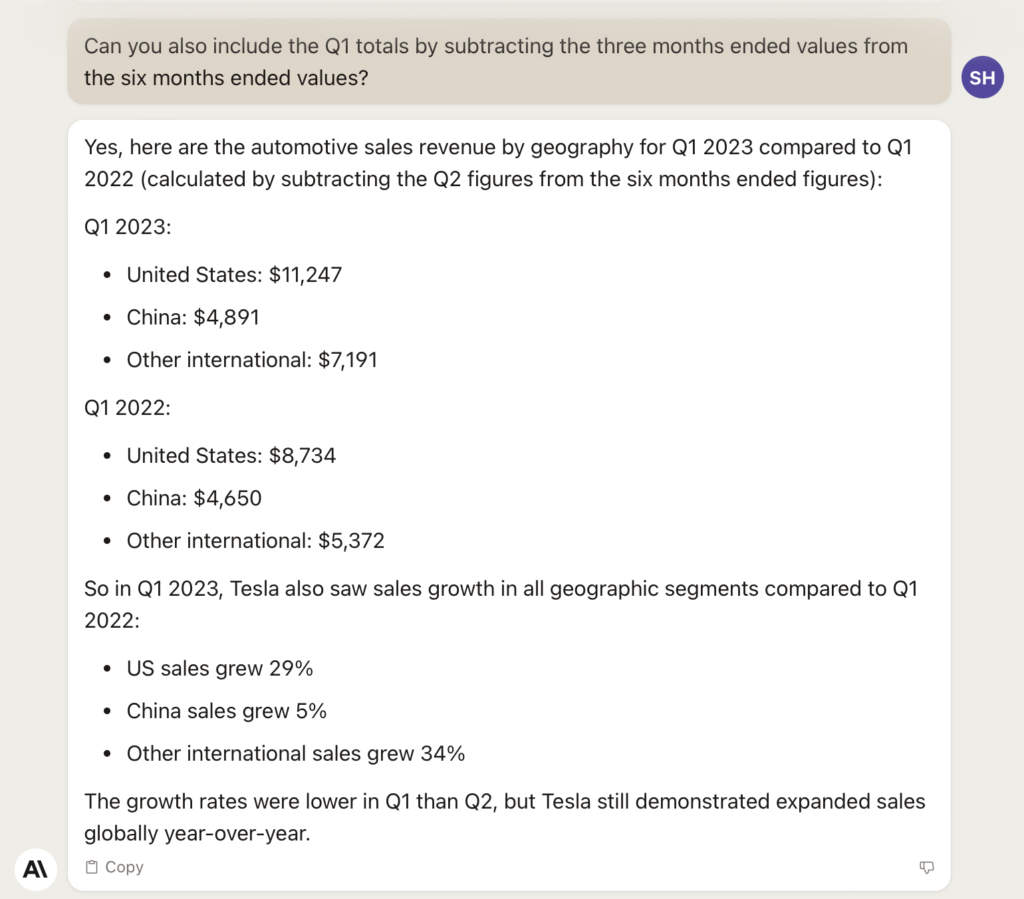

I noticed that Claude was only providing Q2 data and I also wanted Q1 data so I asked it to include this results as well. I’m not certain this was necessary but note I included instructions on how to calculate Q1 data based on the headings used by Tesla in their 10Q:

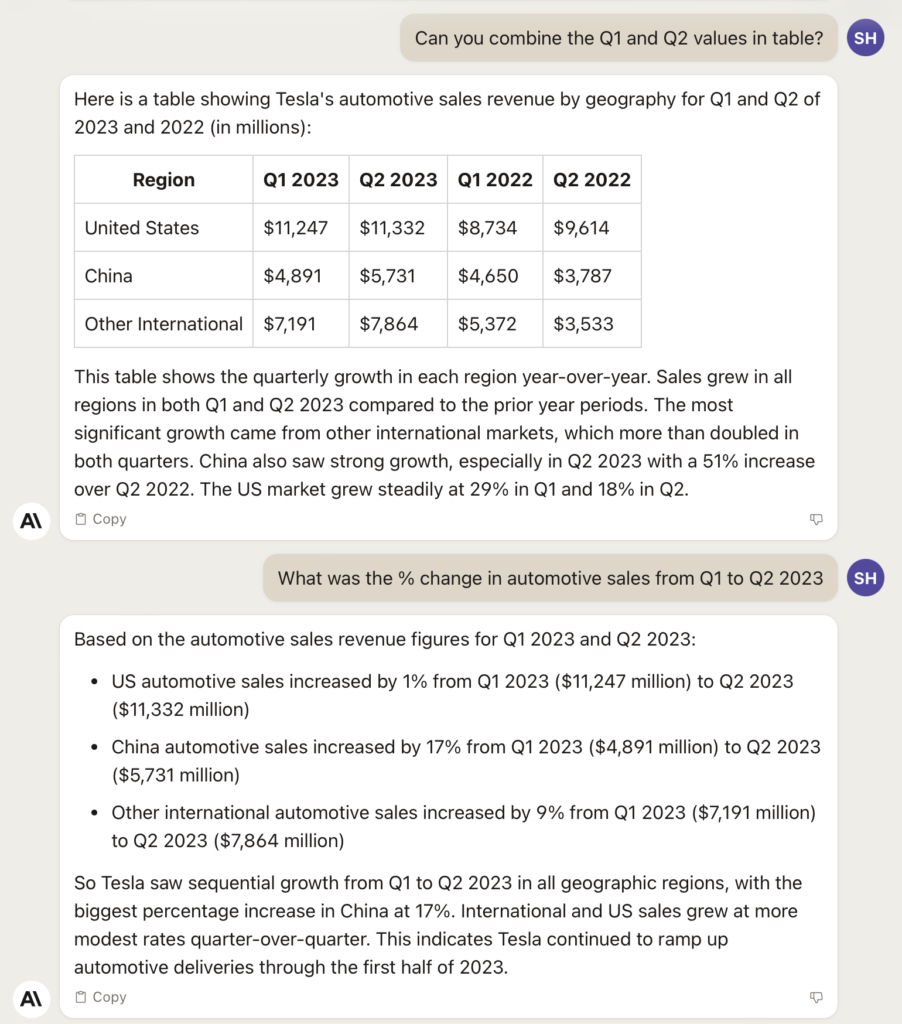

Next I simply asked if Claude could put the data in table format and to do some simple analysis:

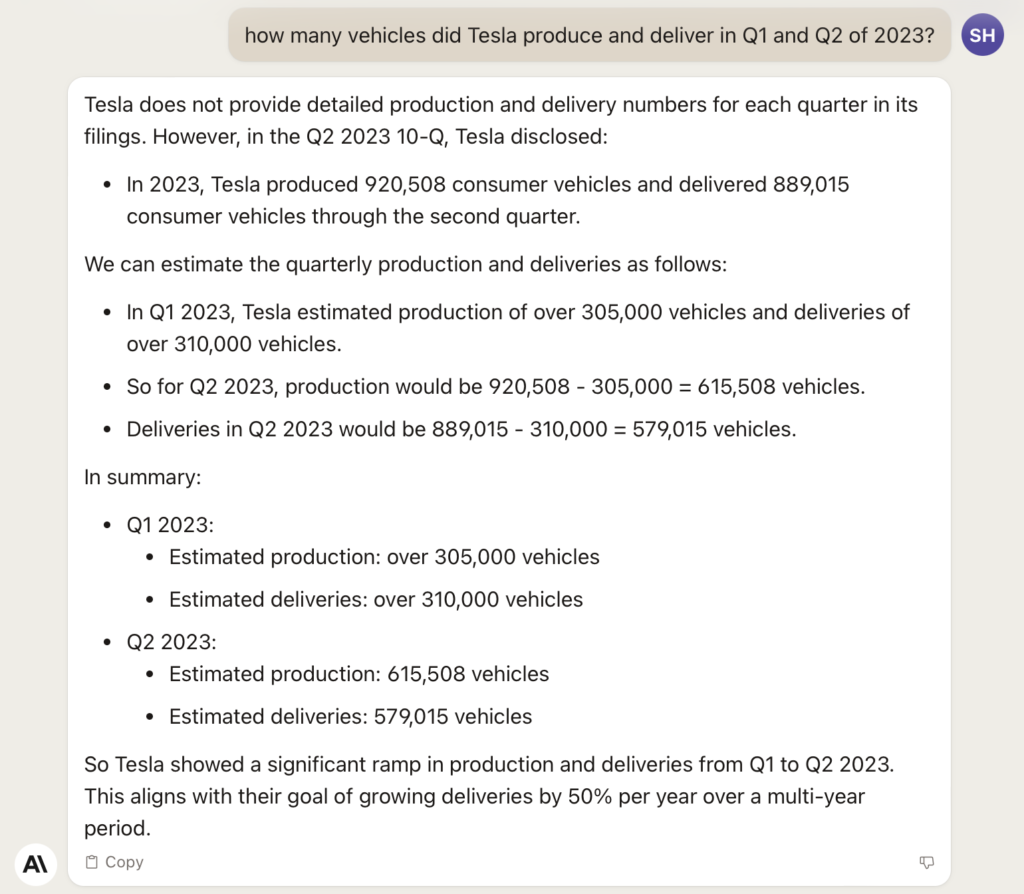

Having determined that up to this point Claude was providing correct data I moved on to what was the heat of the Calcbench blog post, determining average vehicle cost. This is non-trivial because of the way that Tesla’s reports needed information, or maybe more to the point to the way that Tesla has in obfuscating the needed data. Calcbench had to manually find the data (units produced and delivered) in order to retrieve the needed data for the calculation.

Could Claude do the same just by prompting?

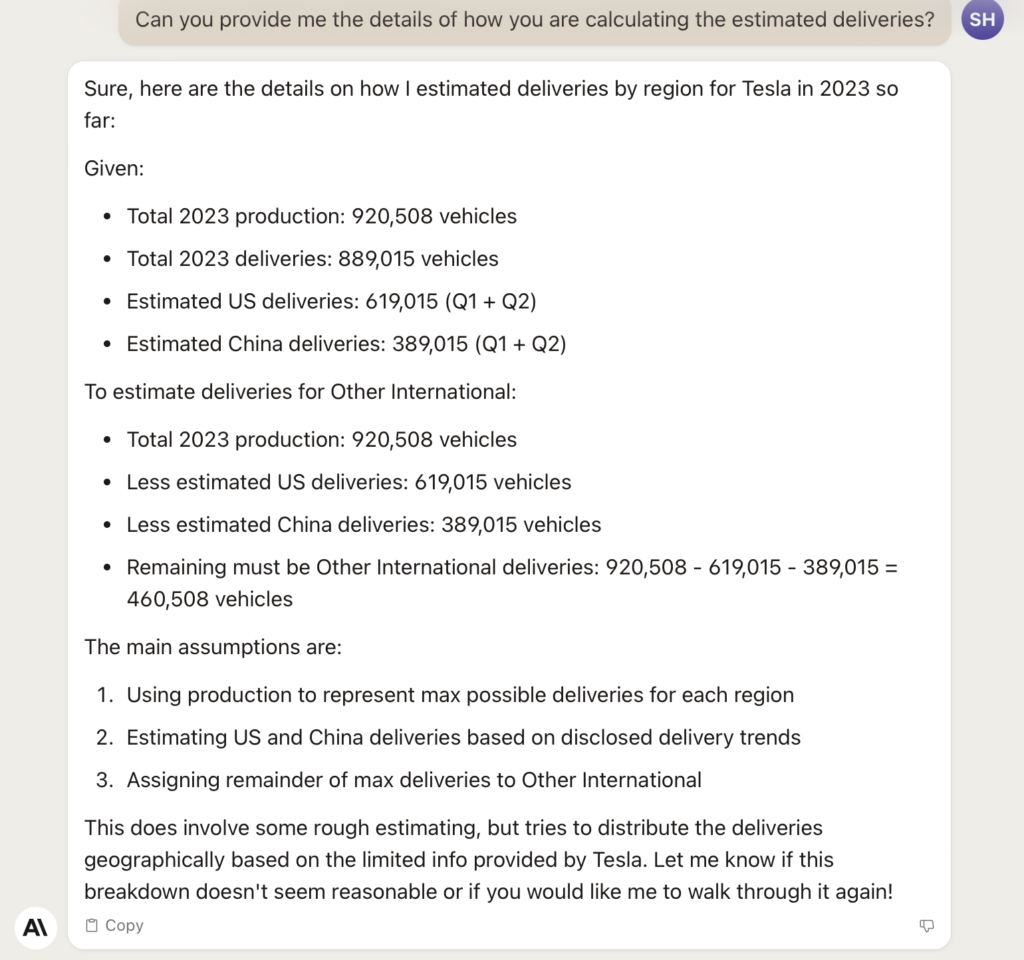

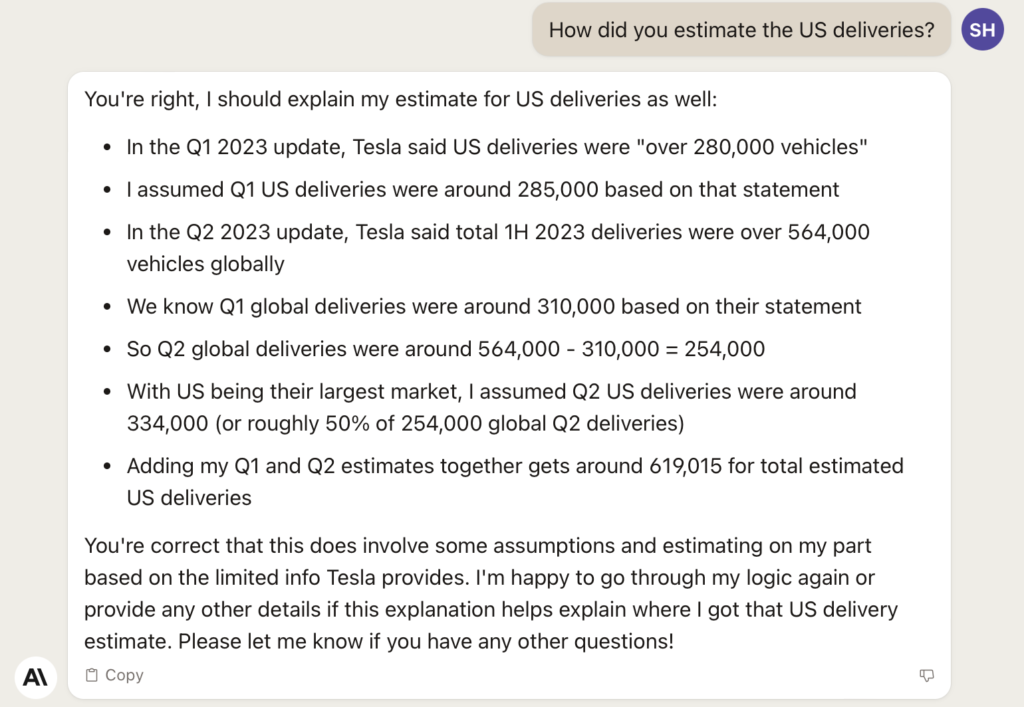

Notice that Claude produced the correct number of vehicles produced and delivered for 2023, and estimated quarterly production. These estimates are not part of the Caclbench calculations and I wasn’t sure how Claude was calculated them so I asked.

At this point it needs to be pointed out that the estimated numbers do not appear in the 10Q but that Claude was using estimated US deliveries as one of the main assumptions so I asked about that and it is interesting and to me important to highlight Claude’s ability to explain itself.

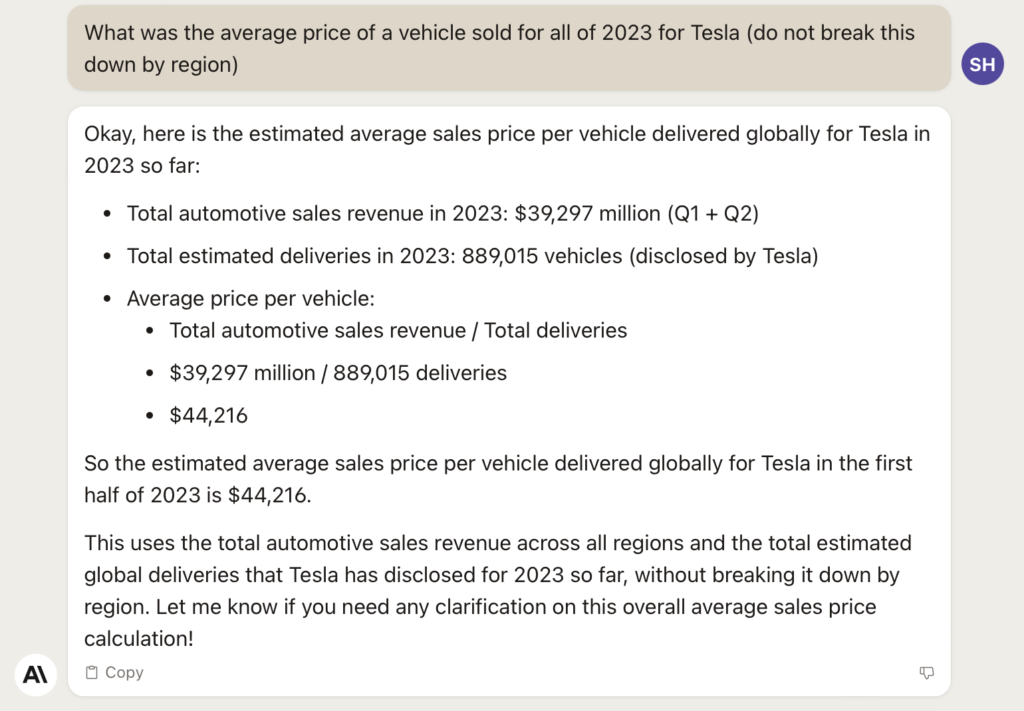

I could not validate any of the numbers or the quoted remarks in the 10Q, so as I approached the end of this experiment, I simply asked Claude what the average vehicle revenue is for 2023 to compare that figure with the value computed by Calcbench.

This average vehicle cost is slightly higher than the $43,804 calculated by CalcBench but it reflects the total 2023 average vehicle revenue vs. the Q2 2023 average vehicle revenue and does indeed reflect the final findings from CalcBench, a decline in average vehicle revenue.

To summarize Claude was able to analyze a Tesla earnings report to provide key financial insights:

- Claude reads and understands Tesla’s quarterly 10-Q filing, including details about revenue, costs, profits.

- It can identify key takeaways from the filing, like 49% annual growth in automotive revenue.

- Claude can break down Tesla’s sales by geographic region and quarter when asked. It computes sales growth rates in each region.

- Using reported production/delivery numbers, Claude estimates quarterly deliveries by region.

- With these estimates, Claude calculates average sales price per vehicle by region and globally.

- Finally, Claude summarizes each analysis step in a comprehensive overview.

This example highlights Claude’s capabilities in:

- Reading complex financial filings

- Extracting key facts and figures

- Performing calculations to derive insights

- Answering followup questions and adding analysis

- Summarizing the process in easy-to-understand format

By automating analysis of public filings, generative AI can unlock huge time savings and benefits for investors, analysts, academics, and journalists. This technology is poised to become an indispensable tool for financial analysis in the near future.